Straight-line Depreciation in Excel: Explained

In this article, you will learn how to perform Straight-line depreciation in Excel.

What does the Straight-line depreciation method mean?

Straight-line depreciation is a standard method used in accounting to allocate the cost of an asset over its useful life. It is a straightforward and widely-used approach to determine the periodic depreciation expense of an asset.

In straight-line depreciation, the cost of an asset is spread evenly over its expected useful life. The formula to calculate straight-line depreciation is:

Where:

Cost of Asset: The original purchase price or acquisition cost of the asset.

Salvage Value: The estimated value of the asset at the end of its useful life. It represents the amount the asset is expected to be worth after it has been fully depreciated.

Useful Life: The expected duration of the asset's usefulness or the period over which it will be depreciated. It is typically measured in years.

By applying this formula, the depreciation expense for each period (usually a year) is determined by dividing the difference between the cost of the asset and its salvage value by the useful life.

What are some uses of Straight-line depreciation in Excel?

Straight-line depreciation in Excel has several uses. Here are some common applications:

- Financial reporting: Straight-line depreciation is commonly used to calculate and report depreciation expense on an organization's financial statements. It helps in accurately reflecting the decrease in the value of assets over time.

- Tax purposes: Straight-line depreciation is often used for tax reporting and compliance. It helps in determining the allowable depreciation expense for tax deductions, which can reduce taxable income and potentially lower tax liability.

- Budgeting and forecasting: By using straight-line depreciation, organizations can forecast and budget for future asset replacements or upgrades. It also helps in evaluating the financial viability and return on investment of capital projects by considering the depreciation expense in the project's cash flow projections.

These are just a few examples of the uses of straight-line depreciation in Excel. The method is widely employed in financial analysis, decision-making, and reporting to allocate the cost of assets and reflect their decrease in value over time.

How to calculateStraight-line depreciation in Excel?

To perform straight-line depreciation in Excel, you can use the built-in function called "SLN." Here's how you can use it:

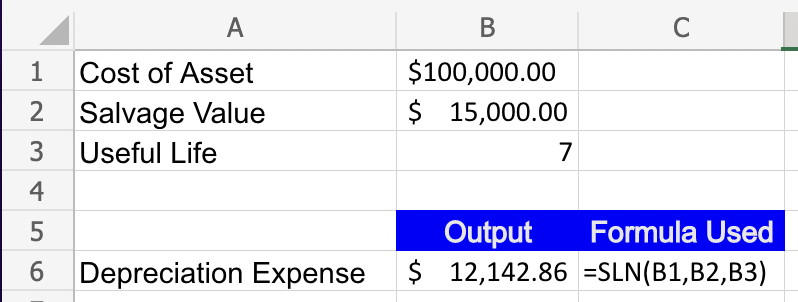

Step 1: In a spreadsheet, enter the necessary information as shown below:

In cell A1, enter "Cost of Asset."

In cell A2, enter "Salvage Value."

In cell A3, enter "Useful Life."

In cell B1, enter the cost of the asset.

In cell B2, enter the salvage value.

In cell B3, enter the useful life in years.

Step 2: In a cell where you want to display the depreciation expense, enter the following formula:

Step 3: Press Enter to calculate the depreciation expense.

The SLN function takes three arguments: the cost of the asset, the salvage value, and the useful life. It calculates the straight-line depreciation expense based on these values.