Declining Balance Depreciation in Excel: Explained

In this article, you will learn how to perform Declining balance depreciation in Excel.

What does the Declining balance depreciation method mean?

Declining balance depreciation, also known as the reducing balance method, is a commonly used depreciation method in accounting. In declining balance depreciation, a fixed depreciation rate is applied to the asset's net book value (cost of the asset minus accumulated depreciation) each year. The net book value is multiplied by the depreciation rate to calculate the depreciation expense. As a result, the depreciation expense decreases over time.

The formula to calculate declining balance depreciation for a specific period is:

The declining balance method allows for faster depreciation of assets in the early years, reflecting the assumption that assets typically lose their value more rapidly in the initial stages of their useful life. This method can be beneficial for assets that have higher maintenance and repair costs as they age or for assets that quickly become technologically obsolete.

How do you perform Declining balance depreciation in Excel?

To perform declining balance depreciation in Excel, you can use the built-in function called "DB.". The syntax of the DB function in Excel is as follows:

The function takes the following arguments:

cost: This is the initial cost or value of the asset.

salvage: This is the estimated salvage value of the asset at the end of its useful life.

life: This represents the useful life of the asset in terms of periods (e.g., years).

period: This specifies the period for which you want to calculate the depreciation expense.

[month]: This is an optional argument and is used when depreciation is calculated on a monthly basis. If omitted, the default assumption is annual depreciation.

Additionally, the following formula is used to calculate the depreciation rate.

Case Study: Declining Balance Depreciation

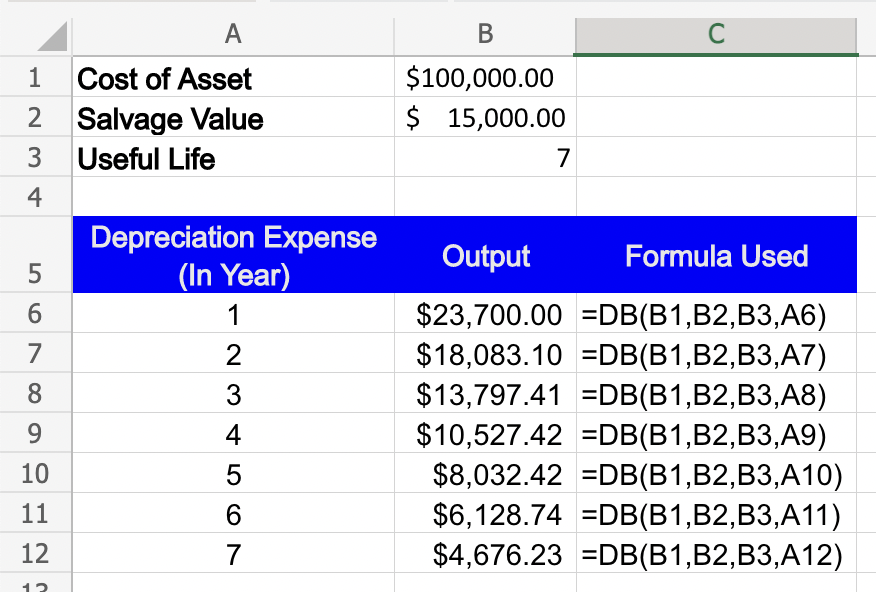

Suppose your company purchases a machine for $100,000 with an estimated salvage value of $15,000. The machine is expected to have a useful life of 7 years, and we want to calculate the declining balance depreciation expense for each year.

Here's how you can use the DB function in Excel to perform the depreciation calculation:

Step 1: In a spreadsheet, enter the following necessary information:

"Cost of Asset.", "Salvage Value.", "Useful Life." & "Period for calculating depreciation expense"

Step 2: In a cell where you want to display the depreciation expense, enter the following formula:

Step 3: Press Enter to calculate the depreciation expense for year 1. Drag the formula down to calculate the depreciation expense for each year.

You can now observe the declining balance depreciation expenses for each year, reflecting the decreasing book value of the asset over its useful life.

Note: Make sure to format the cells appropriately (e.g., currency format for cost, salvage value, and depreciation expense) for better readability.